In 2015, the Government launched a review of the Personal Property Securities Register (PPSR) and detailed several key findings and recommendations.

One of those recommendations focused on the overly technical language used by the PPSR. The official recommendation stated:

“The search summary and search certificate should provide results in plain language that are understandable to the infrequent user.”

Whether a business wants to fill out a registration or check who has an interest over their business or assets, it should be a simple and clear process.

When (or if) these recommended changes will be actioned is anyone’s guess. Luckily, there is a company that’s already simplifying the PPSR process and decoding the technical language.

To help you understand the PPSR better, we’ve explained in plain language some of the common terms used and how to make the process of using the PPSR simple, safe and accurate.

Understanding PPSA, PPSR & PSMI

PPSA

Many of the terms used by the PPSR look and sound similar. It’s easy to see how people get confused. Let’s break it all down.

PPSA stands for Personal Property Securities Act.

Personal Property refers to an asset belonging to a business or individual, whether tangible or intangible. These assets can include any equipment, stock, debtors, goodwill, vehicles etc. (Land, buildings and fixtures are not included). A security is then created over the personal property.

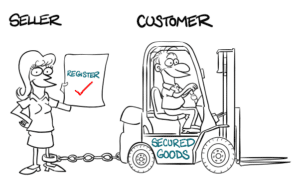

If you have security over personal property, you will need to register it. That way should your counterparty become insolvent by law, you have the legal right to claim the security on your personal property.

PPSR

When you decide to register security over your personal property, this is done via the Personal Property Security Register (PPSR).

The government’s digital register lets everyone know that you have a registered security interest over particular personal property. If you have hired personal property to a business that becomes insolvent, your registration informs everyone that you hold the security interest.

Other people can search that security interest on the public register, which is useful for a few reasons.

- When buying an asset off someone

- When lending money to a person or business

- To check if the personal property has been provided as security

The PPSR is there to protect your business and security interests by:

- Informing you that goods have no existing debt and will not be repossessed

- Protecting your assets should your customer become insolvent

PMSI

There are several types of securities, PMSI is known as the ‘super priority’ security.

PMSI stands for Purchase Money Securities Interest.

The general PPSA law states that the first security interest registered is the first to make a claim on that security. However, PMSI can trump that claim. If your security is challenged by another Secured Party’s security, a registered PSMI wins out.

You generally get the priority of a PMSI when you:

- Enter into an agreement to lend money to finance the purchase of specific goods

- Supply goods on credit (retention of title)

- Hire, rent or bail personal property to a customer

Making the PPSR process simple, safe and accurate

When followed correctly, the PPSR is highly effective at protecting your businesses personal property. However, if one small error is made during the registration process, it can render your claim invalid.

To help reduce the chance of errors, PPSR Cloud has developed an easy-to-follow process that improves the speed and accuracy of registrations. PPSR Cloud’s in-built checking system will help you fill out your information correctly and alert you to any errors or when changes are required.

To find out more about PPSR Cloud and how it can help your business, contact our team today.

The information provided in this article is general in nature. PPSR Cloud are not lawyers and this is not legal advice. If you have missed the timing of your registrations, you should obtain legal advice on how to address the issue. Our suggestions should be treated as suggestions only and you will need to seek specific advice for your circumstances.